Jim Gura is a Financial Advisor and Principal at Stonebridge Financial Group, where he helps families cut through financial complexity and build plans that give them confidence about the future. He specializes in retirement planning and financial risk analysis, with a focus on strategies that can adapt to both life’s surprises and changing market conditions.

What makes Jim’s perspective unique is his background. Before becoming an advisor, he built a career as a market maker in the high-pressure world of options trading. For more than 15 years, he was on the front lines of financial markets and played a role in pioneering the transition to electronic trading on global exchanges. That experience taught him how to spot risks, seize opportunities, and make disciplined decisions under pressure. Today, he channels that hard-earned knowledge into building financial plans that are both practical and personal.

Jim has a reputation for being straightforward, approachable, and even a little unconventional when it helps clients better understand their options. Families appreciate not only his expertise but also his energy, humor, and genuine care; qualities that make him a trusted partner through every stage of life.

Education & Background

Jim built his academic foundation in finance at Joliet Junior College, where he earned his Associate degree, before continuing on to Northern Illinois University to complete his Bachelor of Science in Finance.

In 1994, he launched his career at the Chicago Board Options Exchange as a floor clerk, where he quickly immersed himself in the fast-paced world of open-outcry trading. Those early years gave him firsthand exposure to the inner workings of markets and the discipline required to succeed in high-pressure environments.

Jim then spent more than 15 years at Marquette Partners as a market maker, where he not only refined his trading skills but also played a key role in the industry’s transition from traditional trading floors to electronic platforms that now shape global markets. This combination of formal education and hands-on market experience provided the foundation for the thoughtful, adaptable approach he brings to financial advising today.

Designations & Memberships

Jim holds the Accredited Investment Fiduciary® (AIF®) designation, reflecting his commitment to upholding the highest fiduciary standards and always putting clients’ best interests first.

For a decade, Jim was deeply involved with the Kirkwood Des Peres Chamber of Commerce, serving in leadership positions that shaped the organization and the community it supports. He was Chairman of the Board for a year, and served as Vice Chair of Finance for six years helping strengthen the Chamber’s financial footing and expand its reach. His years of service demonstrate his belief that financial expertise should be used not only for clients but also for the broader community.

Awards & Accomplishments

Jim has been recognized as a Five Star Wealth Manager Award recipient six times, including five consecutive years from 2018 through 2025. This award honors wealth managers who demonstrate exceptional client service and strong professional credentials. For Jim, the recognition is less about accolades and more about what they represent: trust, satisfaction, and the confidence clients place in his guidance.

Before shifting into advising, Jim’s trading career was equally distinguished. His pioneering work in electronic trading and his success as a market maker on global exchanges established him as a respected figure in the financial industry. That practical, real-world experience still informs the way he advises families today.

Personal Life

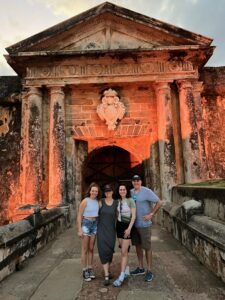

Jim grew up in Southwest Chicagoland, where he learned the values of integrity, hard work, and family; values that remain central to his life. He and his wife, Jennifer, have been married since 2002 and are the proud parents of two adult daughters.

Outside of work, Jim is known for his big personality and love of making memories. He enjoys traveling with his family, especially on their frequent trips to Walt Disney World, which he still calls the “Most Magical Place on Earth.” He also treasures long-standing family traditions like Chicago Bears halftime feasts, which bring together food, laughter, and plenty of spirited conversation.

Those who know Jim best would say he brings the same passion and energy to his personal life as he does to his work. He believes in living fully, celebrating often, and making time for the people who matter most.

Looking Ahead

At Stonebridge Financial Group, Jim’s mission is simple: to give families confidence in their financial future so they can enjoy their lives today. His rare combination of market experience, fiduciary commitment, and larger-than-life personality makes him not only a capable advisor but also a trusted guide through life’s financial decisions.